Posted on 11 Nov 2020

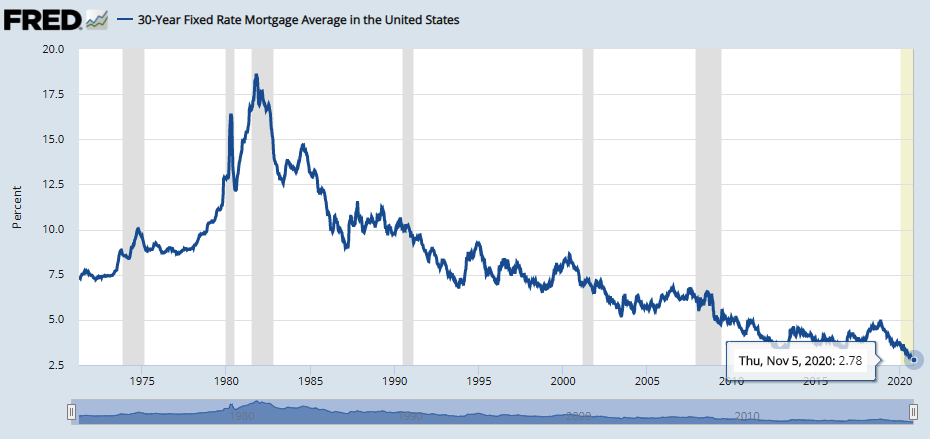

Take a look at the chart below (source: FRED; screenshot taken on the day this article was written).

The average 30-year fixed mortgage rate is at the lowest level. Ever.

So, our friends and clients ask: “Should we jump at the opportunity to buy a house?”

Yes, it may be an excellent time to buy as the cost of borrowing is at an all-time low. But keep in mind that mortgage interest shouldn’t be the only factor driving your decision to buy a home.

There are other things to consider too.

Recently, months of inventory—a metric often used to gauge the health of a particular real estate market—has been lower than usual in many segments of South Florida’s housing market for a number of reasons:

- some potential sellers decided to take advantage of the low interest rates and refinanced their homes;

- others didn’t like the idea of putting their home up for sale during the most crazy, unpredictable time in the recent economic history; and

- yet others didn’t feel comfortable allowing showings because of the pandemic.

The lower inventory coupled with a higher-than-usual demand from the Northeast has pushed the home prices up, benefitting sellers, rather than buyers.

Buying versus waiting also depends on other important considerations. For example,

- If you are currently renting, try to get an estimate of rental prices in your area for at least 3-5 years out. Rapidly rising rental prices may be the tipping point for you. By the way, here is a more on buying vs. renting.

- How much money you have for the down payment, to cover closing costs, and potential expected or unexpected repairs.

- Do you have a healthy credit rating? Other factors may fade in significance if you can’t obtain a mortgage loan on reasonable terms.

- Would this be a primary residence or an investment property? The answer to this question entails such important ancillary factors as property taxes, the amount you’d be willing to spend on renovations, and alternative vehicles for investment.

- Personal preferences is a huge factor too. Maybe you just love owning your own home and making the place uniquely yours. Or, conversely, you prefer the flexibility of renting because you have the kind of a job that may transfer you to another state before you can say “knife.”

You may be surprised that we didn’t make a definite “yes, buy now!” recommendation.

But as you can see, everyone’s situation, finances, preferences, changes in the family, job, desired location, type of home, and soon are so different that making a blanket recommendation for everyone who reads this blog is absurd.

Talk to your realtor. He or she will look at your particular situation, specific to you and your family, and will offer guidance so you can make an informed decision in this complex environment. And, of course, if you aren’t currently working with any realtor, contact us. We’d be happy to help.